Capitalism and the market economy are at the heart of wealth creation, fostering enterprise and creativity and encouraging the best from people: and yet the rich get richer, the poor poorer and the average age of wealth increases: until something snaps and very large numbers of people with no hope say: “up with this we will not put”. Then the pendulum swings back to socialism once more. Democratic capitalism which is not anchored by long-term measures to give genuine equality of opportunity, particularly for the young, is doomed to experience dramatic reverses and to impose a serious degree of unhappiness on those suffering from cycles of deprivation.

Capitalism and the market economy are at the heart of wealth creation, fostering enterprise and creativity and encouraging the best from people: and yet the rich get richer, the poor poorer and the average age of wealth increases: until something snaps and very large numbers of people with no hope say: “up with this we will not put”. Then the pendulum swings back to socialism once more. Democratic capitalism which is not anchored by long-term measures to give genuine equality of opportunity, particularly for the young, is doomed to experience dramatic reverses and to impose a serious degree of unhappiness on those suffering from cycles of deprivation.

Communism was designed to impose equality by heavyweight intermediation, and was no doubt intended to be controlled by a benevolent dictatorship. This was intended to make citizens vassals of the state (‘Dictatorship of the Proletariat’), with little opportunity to be in control of their own destiny. But experience has shown us that you cannot rely on ‘benevolent dictators’, as the collapse of the Soviet Union and rise of the oligarchs has shown. And, by denying its citizens freedom and enterprise, communism stifles wealth creativity, and has to rely on sale of natural resources and cheap labour for its survival.

The middle ground of social democracy may sound an attractive alternative, but its reliance on universal provision of standardised, single-supplier and state-funded services is built on steadily-increasing welfare state expenditure, which itself relies on heavyweight public debt. The resources available to target support for those most in need are continually eroded by what becomes in effect a form of electoral bribery; meanwhile future generations are left to bear the high costs of servicing their ancestors.

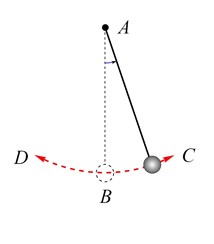

All of these economic/political alternatives rely on excess intermediation, whether by the state or by financial institutions, and all have failed at various times over the past century: the stark evidence of their failures stands out for all to see in the collapse of the Soviet Union, the 2008 financial crash and so many violent revolutions over hundreds of years, and the rising tax-takes, massive public debt and almost non-existent growth rates in Europe. Societies swing across the three systems like a pendulum, reacting against the excesses which reflect the shortcomings of their controlling powers.

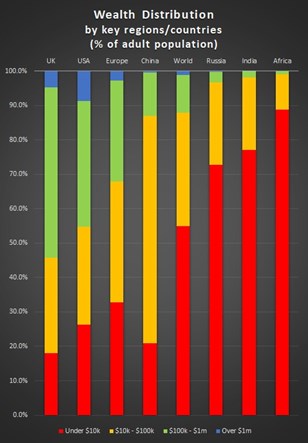

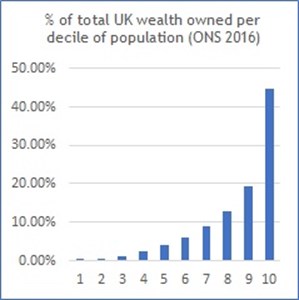

Meanwhile, as the Credit Suisse Global Wealth Databook shows, polarisation of wealth impacts all parts of the world. Even the United Kingdom, which appears to score well compared to other regions, features huge contrasts in wealth participation across society:

Meanwhile, as the Credit Suisse Global Wealth Databook shows, polarisation of wealth impacts all parts of the world. Even the United Kingdom, which appears to score well compared to other regions, features huge contrasts in wealth participation across society:

The human condition is not one which should be ruled by others: that is why disintermediation lies at the heart of our plans to move to a more egalitarian form of capitalism. Disintermediation is one of the key yardsticks by which the effectiveness and fairness of economic systems should be measured. It requires that the impact on the individual is taken into account, and the need for people to take individual responsibility for and control of their lives is recognised.

When we speak of an egalitarian society, this refers to a continual presumption in favour of individual ‘levelling-up’. Individual freedom must allow for some to succeed more than others, but whenever opportunities arise for enabling mass individual participation they should be taken, recognising that a sense of individual ownership brings with it a sense of individual responsibility. One of the great opportunities for this in our time is the technological revolution, and the opportunity to recognise data storage and harvesting by the issue of equity stock holdings.

However, the essence of developing a continual re-adjustment towards a more egalitarian society is that it must be long-term in its application: in governance terms, it must act with constitutional permanence rather than continual legislative adjustment. In terms of inter-generational equity, this is the only way we can look forward to breaking the ‘cycle of deprivation’, to which Sir Keith Joseph referred in the mid-1970s.

This means using the natural human cycle of death and life as the primary route for inter-generational rebalancing, so that inheritance levies are hypothecated to fuel the prospects of enabling young people from disadvantaged backgrounds, so that they are better-placed to achieve their potential in adult life — this would include the provision of individual starter capital accounts and life skills. A truly effective sense of ownership is built over time, and is best accompanied by a combination of learning and earning - in the widest sense. As micro-finance initiatives have shown so effectively, it is the contrast between ‘give a fish to feed for a week, or teach to fish to last for a lifetime’.