Politicians often speak glibly about ownership as if it's a definitive term, but the sense of ownership depends on a whole range of features. In the long term we are all only stewards of what we own, as we can't take it with us when we die. But the reality of ownership still relies on some influential characteristics including the extent to which it offers us participation and the ability to control our assets, and the degree to which it carries with it a sense of responsibility.

There are various styles of ownership, and how that ownership is enabled, and the nature of the asset, can weaken or strengthen the sense of connection which is so essential to a sense of ownership.

Home Ownership

A sense of ownership starts with where you live, and in the United Kingdom that’s almost out of reach now for young people, with generations born after 1970 having significantly lower levels of home ownership. The average first time buyer age was 24 in 1970, 28 in 2000 and 37 in 2013. Rock-bottom interest rates have inflated asset values massively, and have given a further massive twist to the polarisation of wealth.

Property ownership - real estate - is also severely challenged by debt, and almost two decades of easy borrowing at such low interest rates really hasn't helped. Bankers and finance companies have strained to maximise loan availability, to the extent of exceeding 100% through ‘shared ownership’: but when you're in hock to the bank to such a colossal extent, do you really get a sense of ownership, or does it just pile on anxiety?

Leverage is a key problem which we must solve in order to relieve the stress that can accompany super-size mortgages; and, although some property professionals might try and portray the alternative of leaseholds as ‘ownership’, they are, of course, no such thing — particularly if they’re short duration.

Likewise the concept of ‘shared ownership’ frequently results in the occupier carrying all the obligations while the institutional ‘sharer’ takes the benefit of price movements without bearing any of those burdens: as a result, ‘shared ownership can feel more like a trap than bringing a sense of economic freedom.

Stock Ownership

Over thirty years ago, The Share Centre launched the Mail on Sunday Share Service, with the following encouragement to get involved:

‘SHARE (STOCK) OWNERSHIP - The essence of investment

Shares - at times they may delight you, at times confuse you, but very rarely will they fail to fire your imagination.

PEOPLE own shares for all sorts of reasons: almost always capital gain, either looking for the quick turn or the long-term, often for the interest in owning a share of British business, often because the charges are lower than other forms of investment. A share portfolio is indeed the essence of investment.

COMPANIES want people to own their shares too: personal investors take a wider interest in the company than investment institutions, and shareholder customers and employees build that interest into all areas of the company’s business.

It's good for our COUNTRY too that people should own their share of British business: share ownership knits a free enterprise economy together by bringing the power of ownership, the surge of the market, and the ingenuity of the workforce together under the same head’.

It was the start of a radical new approach to provide stock ownership for all, and The Share Centre went on to provide unprecedented access to participation through new issue distribution, providing free shares in its own business to its customers, being the first mover in a new all-employee share ownership plan, getting Company Law changed to enfranchise nominee shareowners, and providing a huge range of investment and financial education services for young people.

The link between ownership and responsibility is a vital component in this. When someone owns something, be it a house or a car, they generally care for it. If it's a house, the walls are painted, the garden brims with flowers; if it's a car, it's generally clean and well maintained.

And so it is with owning shares in a company. Every time an M&S share owner walks into Marks and Spencer, they feel a buzz of responsibility for the way it's run. Meanwhile, if customer stock owners are recognised with special offers or discounts, that sense of connection is strengthened further.

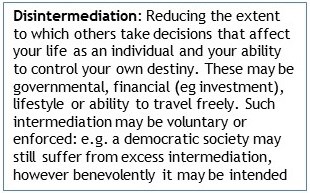

The need for dis-intermediation

But then there's excess intermediation. Of course, many people choose to pass control of their investments over to others, often because they don't have the time, the confidence or the knowledge to manage them directly. But stepping away from control should be a conscious decision by the owner, not an imposed decision which obscures access and transparency so that others can wield power. In financial services there are far too many examples of excess intermediation — fund management, pensions, life insurance, etc.. — and the absence of proper financial education simply exacerbates the process of keeping people in the dark about their own investments.

But then there's excess intermediation. Of course, many people choose to pass control of their investments over to others, often because they don't have the time, the confidence or the knowledge to manage them directly. But stepping away from control should be a conscious decision by the owner, not an imposed decision which obscures access and transparency so that others can wield power. In financial services there are far too many examples of excess intermediation — fund management, pensions, life insurance, etc.. — and the absence of proper financial education simply exacerbates the process of keeping people in the dark about their own investments.

A few years ago, there was a wave of protest movements brought together by the word ‘Occupy’: a major camp took place just outside St Paul's Cathedral in London. Many saw it as simply a reaction to the 2008 financial crash, but it had still deeper roots. An hour or so spent in conversation with one protester in the camp just outside the financial district in Boston. Massachusetts helped in working through the issues behind their concerns, and that discussion concluded that ‘Occupy’ was really a call for disintermediation.

The financial sector has grown fat on the takings of the middleman, and people don't like it. Politicians respond by introducing layers of regulation, which impose still more complexity and cost. Regulators have made some progress in reducing the more opaque forms of self-enrichment, but centres of the financial world remain vibrant symbols of parasitic intermediation for all to see.

You can only empower people by democratising expertise, not by wrapping it up in ivory towers.

The free market embodies many perspectives: open competition, prices responding to supply and demand, enterprise and creativity - but also excess and self-interest. At its heart is the free ownership of capital - or is it so free? Because, to the extent that it is owned by individuals it is excessively concentrated and, to the extent that it is owned by institutions, it carries no meaning to the general public, no sense of ownership - and therefore no reason why people should feel responsible for its well-being.

Excess intermediation kills off that vital link between ownership and responsibility, whether it’s by financial institutions or the state. By concentrating the power to steer these great engines of economic growth away from the people that they serve and employ, we must expect that those people will eventually bite the hand of those who expropriate the power - whether they are financial institutions or socialist governments.

Over the past couple of decades, we’ve seen just such a concentration of power in financial markets, both in the US and the United Kingdom. In New York, there were 8,000 listed companies at the peak. Now there are fewer than 6,400 on NYSE and NASDAQ. London has seen a similar trend. Ten years ago there were more than 3,000 companies quoted on the main and junior markets. By 2022, the number had dropped to less than 2,000. The traditional public market for equities is now in global decline.

There are of course far-reaching consequences for markets and investors, but there is a deeper concern here too. The real casualty is popular support for the free market itself: because, if individuals are denied access to investing directly in stock, they can have no sense of ownership in, nor responsibility for, the great engines of industry which create wealth in such abundance.

This may help explain why this scale of intermediation drove the ‘Occupy’ protests, but the concentration of power has happened notwithstanding the generally healthy state of the world economy and the businesses that support it.

One of the main challenges is the success of private equity in providing an alternative to public markets. The rise of the buy-out industry means there are lots of alternatives for company owners who wish to sell. At the same time, a massive rise in regulation, and layer upon layer of governance codes, has made public listing a burden that many directors can no longer be bothered with.

Most investment institutions have benefitted from the rising proportion of asset allocation dedicated to private equity, and the strong performance it has achieved. These include pension funds - so individuals do share in their performance, if not in any sense of ownership. The great Family Offices, Sovereign Wealth funds, hedge funds and insurance companies are all investing in Private Equity. This is because they all share the benefits of size: they can invest in the large amounts that Private Equity managers are prepared to accept, whereas personal investors cannot.

Stock owner engagement

These examples of excess intermediation should not be confused with custodial administration using ‘bare trustees’. Advocates of registered share ownership often try to present this as intermediation, but it's nothing of the sort: rather, it enables the service organisation to be the owner’s agent rather than the agent of the stock-issuing corporate, and it helps to develop investment awareness, as a share portfolio builds and diversifies. It must, of course, be accompanied by full opportunity to exercise stockholder engagement: this process started in the UK with the Companies Act 2006 Part 9, but it needs further strengthening. We need to make the supply of company communications and voting access mandatory for all such regulated custodians.

Another key feature of participation is the right, together with other stock owners, to circularise others who own the stock, and to bring forward resolutions for consideration at a General Meeting. In the UK, company law still sets the threshold for this participation by reference to the nominal value of the shares, which bears no relevance whatsoever to their market value. So, whereas in one company the threshold may be measured in £millions, in others it could be a few pounds.

If ‘Stock for Data’, discussed in one of our other research areas, is introduced, it may well be on a custodial administration basis in order to provide a straightforward route to global coverage. Widespread stock ownership is a key objective for moving to a more egalitarian form of capitalism, but it needs to include the provision of financial awareness life skills to help build capability for looking after the asset and the income and its potential capital gain, and the risks associated with asset ownership — in other words, democratising expertise.

All this helps to foster active involvement in company governance, so that the sense of responsibility which comes with ownership breaks down the ‘us and them’ divisions in society.

.. and a word on the concept of ‘mutuals’ with respect to sense of ownership and distributed governance

True ownership involves control and possession of the asset, whether it be property or stock: that means retaining the ability to crystallise its value. There are many examples of participation which don't do this: in particular, co-operatives and mutuals speak of participation, but only while the individual remains an employee or a member. Businesses such as the John Lewis Partnership, building societies and friendly societies are typical examples of this: they present themselves as inclusive, but there is no monetary value in the participation of a capital nature.

It's for these reasons that ‘Stock for Data’ refers to stock issuance in return for data storage and harvesting, and the (disposable) stockholding should increase as the relationship moves forward from year to year.

Legal recognition of ownership rights

Ownership in any society is only as good as its recognition in law. Western democracies have centuries of experience in building property rights into their constitutions, and no doubt this is one of the key reasons why London has attracted so much investment over the years. But there are so many examples of property rights being trampled on, whether by political systems, by government dictact or unfair taxation, or by outright theft and destruction, as in the war in Ukraine.

If people are to have confidence in a sense of ownership and to build the responsibility that it engenders, they must know that acceptance of their property rights is sacrosant — and this confidence must extend globally. There is a lot to do in this respect.

Reversing systemic dilution of stock ownership

Further structural changes are needed to embed personal share ownership more effectively. There are some key improvements where change is required in order to recognise the major contribution that ownership, rather than trading, can bring in delivering participation in wealth creation for all. The media focuses so often on share-dealing and short-term price movements, but most investors are long-term holders. They are not day-traders or gamblers: they’ve invested for long-term growth accompanied by, where available, a regular flow of dividends.

For example, a major handicap for the personal stock ownership segment in a listed company is that every time there is a rights issue, raising more capital from existing stock owners, the proportion of personal investors holding the stock reduces sharply. Institutional investors strengthen their position, and financial intermediation turns the screw a little harder.

This is because, for institutions the ‘old’ and the ‘new’ money are held by the same entity — so pre-emption rights work in their favour. But for personal investors, the ‘old’ money currently belongs primarily to those who are disinvesting in old age: they often have no ‘new’ money to take up the nil-paid rights. However personal investors who do have that ‘new’ money but don't hold the ‘old’ stock are excluded from taking part by those same pre-emption rights.

In order to address this, it should be mandatory for the rump sell-off of nil-paid rights at the end of the ‘Call’ period to be offered to all personal investors (via their retail investment service), alongside the institutions. At least this would help reduce the dilution in personal investor holdings in listed companies every time they carry out a secondary capital raising via a rights issue.

This change would significantly raise the profile of personal stock ownership. It would be a significant step forward in moving to a more egalitarian form of capitalism, in which stock owner engagement, and protection against systemic dilution, are key features.

Risk

Many people think financial activity is more of a science; but when it comes to investment there’s no doubt that it is definitely an art, where there are no right or wrong answers and it's all down to subjective judgement.

The old saying about death and taxes could read ‘Risk, like tax, is always with us’. A few key points are as follows:

- Risk is a subjective judgement.

- Risk is relative, depending on, for example, how you approach that risk, the nature of the risk and even your age.

- Risk does not remain constant, but can change when external events change.

- What is considered more risky by some may be considered less risky by others.

- And lastly, there are some risks that only a professional should take.

Earning money by working is very different from trying to build value from capital gains on investment, and the key difference is real risk of loss of capital value. This needs to be taken into account in the tax system to encourage people to invest in risky assets like equity stocks as opposed to other alternative uses to which their money can be employed.

Risk is also significantly increased by leverage: the financing of asset purchase with debt. With the exception of derivatives (options and futures), this is not commonplace when buying stock investments: however, it is the norm when making a property purchase. Buying a flat or house is often seen as comparatively risk-free: the servicing costs may be heavy, but people don’t usually expect to lose capital value. However, an 80% loan-to-value mortgage magnifies the impact of price movements fourfold, so a significant fall in property prices can result in the risk of losing more than your initial investment: in other words, property purchase can be potentially more risky than buying stocks.

A couple of final notes on ..

Compound Interest

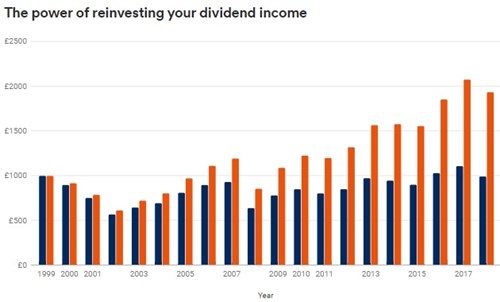

It's also worth bearing in mind the compounding effect of interest costs and stock market dividend yields when looking at these long-term issues - the chart below shows the substantial compounding effect of dividends for FTSE-100 investments over the past twenty years, during which actual index values have hardly moved:

.. and Investment Clubs

A good way to help build awareness of stock investment is through membership of an investment club. This is a very simple concept: it’s just a group of people finding company and enjoyment in researching, discussing, selecting and investing in a portfolio of shares and funds. In the UK, it’s not a regulated activity, and it doesn’t have to be an incorporated company or any other formal body. It helps to have a simple written agreement between the members to ensure everyone shares fairly in any gains and losses, and they need to choose one of their number to control the account, although all members should be able to login and view what’s there, the valuations in the account and its underlying investments.

A typical investment club will have 5-10 members, but they come in all shapes and sizes. Some meet regularly in a local tavern, others communicate internationally by teleconferencing, some have particular expertise in different fields or businesses, some are just a group of close friends having fun: it’s also a great way for older folk to keep in touch. Whereas individuals on their own are often anxious about getting started with investing, the Investment helps to build each member’s confidence through teamwork and good companionship.